At a moment like this, the last thing we can afford is four more years of the tired, old theory that says we should give more to billionaires and big corporations and hope that prosperity trickles down to everyone else....It's not change when John McCain wants to give a $700,000 tax cut to the average Fortune 500 CEO. It's not change when he wants to give $200 billion to the biggest corporations or $4 billion to the oil companies or $300 billion to the same Wall Street banks that got us into this mess. It's not change when he comes up with a tax plan that doesn't give a penny of relief to more than 100 million middle-class Americans. That's not change....The choice in this election isn't between tax cuts and no tax cuts. It's about whether you believe we should only reward wealth, or whether we should also reward the work and workers who create it. I will give a tax break to 95% of Americans who work every day and get taxes taken out of their paychecks every week. I'll eliminate income taxes for seniors making under $50,000 and give homeowners and working parents more of a break. And I'll help pay for this by asking the folks who are making more than $250,000 a year to go back to the tax rate they were paying in the 1990s. No matter what Senator McCain may claim, here are the facts - if you make under $250,000, you will not see your taxes increase by a single dime - not your income taxes, not your payroll taxes, not your capital gains taxes. Nothing. Because the last thing we should do in this economy is raise taxes on the middle-class.

Once again I think the best way to judge Sen. Obama is by examining what he actually says. He begins by criticizing the tax cuts of the Bush Administration, which he describes as geared towards the wealthy and corporations, and accuses John McCain of wanting to continue down this road with further such reductions.

And he's basically right.

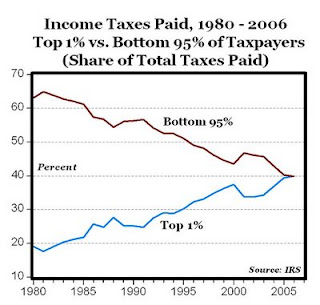

Let's be honest, the rich have disproportionately benefited from the tax policy enacted under Bush -- but so what? After all, the rich shoulder a disproportionate amount of the tax burden in the first place, particularly income tax:

Source: Carpe Diem.

What has occurred in this country since the George HW Bush Administration is a tax policy in which tax rates imposed on the rich have steadily increased at a disproportionate rate. Indeed, we have come to a point where a growing number of Americans pay zero income tax:

Source: Tax Foundation

Thus, if you are going to cut taxes, you can just about guarantee that the rich are going to benefit because they pay most of the taxes! If you think about it the approach taken by Democrats is really quite genius, they have put us in a place where there is basically no way that substantial tax cuts can be enacted without most of the spoils going to the wealthy. And, as Obama says in the second part of his speech, he wants to make the tax code even more lopsided with further reductions in the lower income brackets along with -- not mentioned in his speech -- tax increases on higher income brackets. A smaller and smaller number of taxpayers are going to be sharing a higher and higher share of the tax burden.

This often leads to much teeth-gnashing on the right about the impact this has on economic growth, but Obama's plan gets at something more fundamental -- it is deeply unfair and bad for democracy. Fairness is when we all get treated the same, not when some of us are asked to surrender a higher percentage the fruits of our labors than others. As much as anything this is why we should have a flat income tax. Under a flat tax, if you make 10 times more than someone, you pay 10 times more tax. It's fair.

We also have come to a bad place when the many can vote themselves an increasing number of benefits at the expense of the few. Past a certain point it becomes tantamount of legalized robbery, and places severe stresses upon the very underpinnings of our society.

There is a quote that many on the left of fond of quoting from Oliver Wendell Holmes Jr. -- "I like to pay taxes. With them I buy civilization." If one accepts the premise of this quote, then one must also concede that far too many people are not contributing to civilization. Indeed, one could say that we have arrived at a system that is increasingly uncivilized, and under the Obama plan it is set to become even more so.

1 comment:

Read your blog.Liked it.Here is mine on the evils of taxation!

http://www.reasonforliberty.com/current-affairs/the-evils-of-taxation.html

Post a Comment